IRS EIN Application

Employer Identification Number (EIN) through IRS EIN Application is required for anybody who is thinking about beginning a business whether little scale or large scale. Therefore, every intending financier has to understand exactly what the IRS EIN Application is and the best ways to utilize it when it pertains to preparation of their annual tax statement for the IRS and staying away from problem with the government.

Apply for your EIN number online today at Federal EIN Application

Just as every United States person comes equipped with a Social Security number, every business signed up in the US has a Company Identification Number. EIN is the corporate variation of a social security number, and it’s released to companies that are required to provide tax declarations to their tax attorneys.

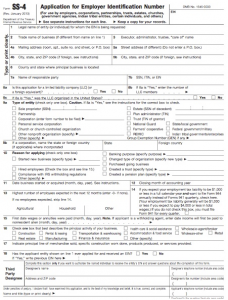

IRS EIN Application can be a challenging and time-consuming process specifically if you don’t know where to begin. It’s actually a big hassle for instance, on average, it takes an individual more than an hour and a half just to go through how to apply for an EIN, fill out the type, and mail it in, never mind the time waiting on hold if you pick to submit by phone.

IRS EIN Application Online Information

Applying by mail takes 4-5 weeks. As an entrant into the marketplace, all you dream of is to concentrate on how you can rise above your competitors; you do not have plenty of time pursuing other things apart from matters to do with developing your customer base. That’s why you require a much faster and more reputable method to finish your application and obtain the number.

A lawyer who is concentrated on IRS EIN Application Online can take the trouble from obtaining this unique nine-digit number that is provided by the Internal Revenue Service to entities operating in the United States for recognition functions.

They know every detail of the process and can make certain that your application is approved, and Employer Identification Number provided within a few days. Through a knowledgeable attorney, you can acquire the number quick but at a price.

With expert assistance, you can get your company identification number by the next business day either by phone, email or fax, and a follow-up Internal Revenue Service type from your consultant. It couldn’t be easier than this!

Small companies with an IRS EIN Application Online take pleasure in a whole host of benefits unlike businesses without one. Here is how having this unique tax identification number used to recognize entities can work to your benefit if you own a company entity;

Although you can develop your company without an EIN, doing so restricts the kinds of businesses you can run. For instance, you cannot form a collaboration or corporation when your business does not have Company Identification Number. So that indicates you will not delight in the advantages that feature these types of businesses consisting of pass-through tax, liability defense and more.

Without an EIN, both a collaboration and a corporation run out concern as far as company structure goes. Complete your IRS EIN Application online today to delight in all the advantages that are readily available when it concerns a lawfully recognized organizational framework for performing business (company structure).

As a sole proprietor, your dream is to see your business grow from a sole proprietorship with a single worker into a huge corporation with a number of branches across the country or world and numerous workers. Without an Employer Identification Number, it’s impossible for your dream to come true.

The law doesn’t enable you to hire staff members without an EIN Application Online from the Internal Revenue Service for reporting taxes and other files. Your state likewise needs this unique company identification number when reporting details about your staff members to the state. Get your EIN online today with the help of a professional.

A crucial benefit of getting an Employer Identification Number for your company is that this will allow you to establish a company account and make an application for credit. Banks do not permit business individuals to develop company accounts without this unique nine-digit number.

Complete your IRS EIN Application online today with the help of an expert and get your Employer Identification Number by the next business day so you can start to manage your business funds in a more effective method.

As a self-employed person, you wish to think about producing your very own retirement plan as early as possible. You need to make sure that you have enough cash to provide the sort of retirement way of life you picture by the time you retire.

Just if you have actually established an efficient retirement plan to secure the assets you have worked to obtain will your retirement be comfortable and enjoyable.

Developing a good retirement plan requires the use of an Employer Identification Number. Complete your IRS EIN Application online today and protect your retirement dreams.

Compensation paid to Nonresident Alien employees go through unique graduated withholding rates. An alien is somebody who is neither a U.S. resident nor U.S. nationwide. Additionally, this person does not hold a permit.

If you have such staff members in your company, you must withhold taxes on their payments as needed by the law. You can take pleasure in the benefit of having nonresident alien employees work for you but just if you have an Employer Identification Number.

Although in some cases you may unknown all the info needed on the application, it is necessary to complete the kind online and send it rather than sending in paper or fax with missing information. This is due to the fact that when Internal Revenue Service gets paper or faxed forms with details missing, more time is needed to process that application compared with an online application with the exact same issue, delaying the issuance of your Employer Identification Number. You can get your EIN much quicker if you go the online way.

From a monetary viewpoint, having a Company Identification Number features numerous advantages. If you wish to obtain it quicker and less painfully, you understand the drill. Finish your IRS EIN Application online with us today. Our company offers processing of EIN and LLC, so you do not need to hire an expensive lawyer.